Page 12 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 12

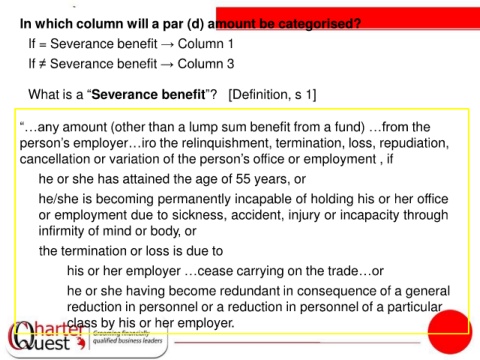

In which column will a par (d) amount be categorised?

• If = Severance benefit → Column 1

• If ≠ Severance benefit → Column 3

• What is a “Severance benefit”? [Definition, s 1]

“…any amount (other than a lump sum benefit from a fund) …from the

person’s employer…iro the relinquishment, termination, loss, repudiation,

cancellation or variation of the person’s office or employment , if

(a) he or she has attained the age of 55 years, or

(b) he/she is becoming permanently incapable of holding his or her office

or employment due to sickness, accident, injury or incapacity through

infirmity of mind or body, or

(c) the termination or loss is due to

(i) his or her employer …cease carrying on the trade…or

(ii) he or she having become redundant in consequence of a general

reduction in personnel or a reduction in personnel of a particular

class by his or her employer.