Page 11 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 11

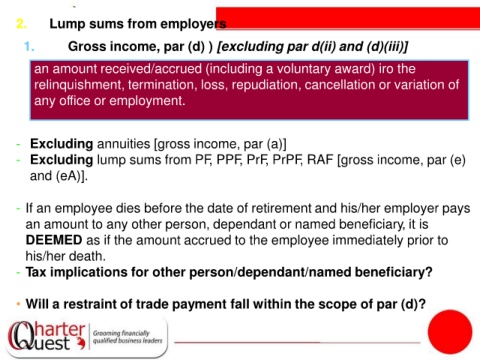

2. Lump sums from employers

1. Gross income, par (d) ) [excluding par d(ii) and (d)(iii)]

an amount received/accrued (including a voluntary award) iro the

relinquishment, termination, loss, repudiation, cancellation or variation of

any office or employment.

- Excluding annuities [gross income, par (a)]

- Excluding lump sums from PF, PPF, PrF, PrPF, RAF [gross income, par (e)

and (eA)].

- If an employee dies before the date of retirement and his/her employer pays

an amount to any other person, dependant or named beneficiary, it is

DEEMED as if the amount accrued to the employee immediately prior to

his/her death.

- Tax implications for other person/dependant/named beneficiary?

• Will a restraint of trade payment fall within the scope of par (d)?