Page 6 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 6

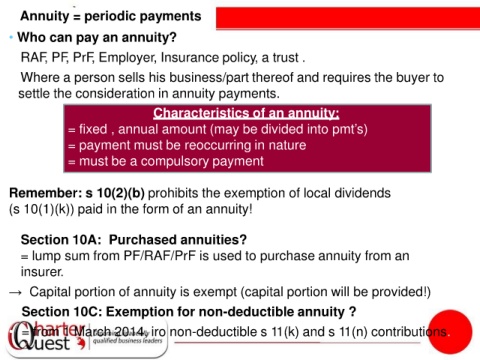

Annuity = periodic payments

• Who can pay an annuity?

- RAF, PF, PrF, Employer, Insurance policy, a trust .

- Where a person sells his business/part thereof and requires the buyer to

settle the consideration in annuity payments.

Characteristics of an annuity:

= fixed , annual amount (may be divided into pmt’s)

= payment must be reoccurring in nature

= must be a compulsory payment

Remember: s 10(2)(b) prohibits the exemption of local dividends

(s 10(1)(k)) paid in the form of an annuity!

• Section 10A: Purchased annuities?

• = lump sum from PF/RAF/PrF is used to purchase annuity from an

insurer.

→ Capital portion of annuity is exempt (capital portion will be provided!)

• Section 10C: Exemption for non-deductible annuity ?

• = from 1 March 2014, iro non-deductible s 11(k) and s 11(n) contributions.