Page 4 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 4

The way life goes….

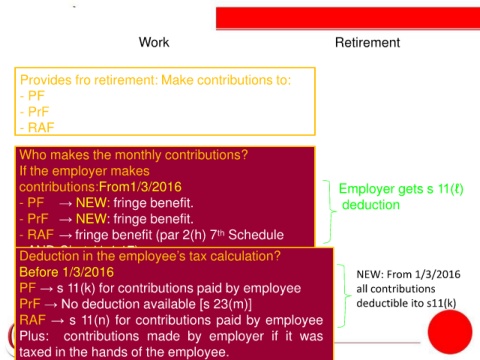

Work Retirement

Provides fro retirement: Make contributions to:

- PF

- PrF Compulsory ito salary package

- RAF → Employee acquires it from insurance co

Who makes the monthly contributions?

If the employer makes

contributions:From1/3/2016 Employer gets s 11(ℓ)

- PF → NEW: fringe benefit. deduction

- PrF → NEW: fringe benefit.

- RAF → fringe benefit (par 2(h) 7 Schedule

th

AND Chpt 11.4.17)

Deduction in the employee’s tax calculation?

Before 1/3/2016 NEW: From 1/3/2016

PF → s 11(k) for contributions paid by employee all contributions

PrF → No deduction available [s 23(m)] deductible ito s11(k)

RAF → s 11(n) for contributions paid by employee

Plus: contributions made by employer if it was

taxed in the hands of the employee.