Page 5 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 5

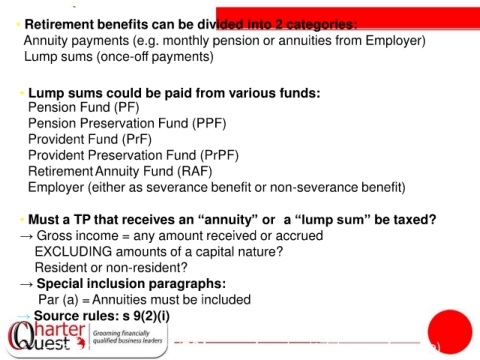

• Retirement benefits can be divided into 2 categories:

- Annuity payments (e.g. monthly pension or annuities from Employer)

- Lump sums (once-off payments)

• Lump sums could be paid from various funds:

- Pension Fund (PF)

- Pension Preservation Fund (PPF)

- Provident Fund (PrF)

- Provident Preservation Fund (PrPF)

- RetirementAnnuity Fund (RAF)

- Employer (either as severance benefit or non-severance benefit)

• Must a TP that receives an “annuity” or a “lump sum” be taxed?

→ Gross income = any amount received or accrued

EXCLUDING amounts of a capital nature?

Resident or non-resident?

→ Special inclusion paragraphs:

Par (a) = Annuities must be included in gross income.

Par (d), (f), (e) and (eA) = lump sums form part of gross income.

→ Source rules: s 9(2)(i)

= Pension or annuity x (RSA years of service / total years of service)