Page 286 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 286

Appendix 2

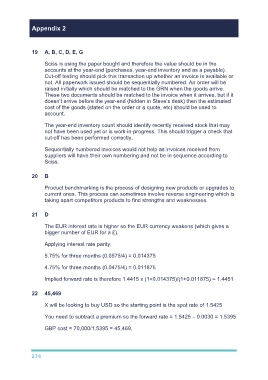

19 A, B, C, D, E, G

Sciss is using the paper bought and therefore the value should be in the

accounts at the year-end (purchases, year-end inventory and as a payable).

Cut-off testing should pick this transaction up whether an invoice is available or

not. All paperwork issued should be sequentially numbered. An order will be

raised initially which should be matched to the GRN when the goods arrive.

These two documents should be matched to the invoice when it arrives, but if it

doesn’t arrive before the year-end (hidden in Steve’s desk) then the estimated

cost of the goods (stated on the order or a quote, etc) should be used to

account.

The year-end inventory count should identify recently received stock that may

not have been used yet or is work-in-progress. This should trigger a check that

cut-off has been performed correctly.

Sequentially numbered invoices would not help as invoices received from

suppliers will have their own numbering and not be in sequence according to

Sciss.

20 B

Product benchmarking is the process of designing new products or upgrades to

current ones. This process can sometimes involve reverse engineering which is

taking apart competitors products to find strengths and weaknesses.

21 D

The EUR interest rate is higher so the EUR currency weakens (which gives a

bigger number of EUR for a £).

Applying interest rate parity:

5.75% for three months (0.0575/4) = 0.014375

4.75% for three months (0.0475/4) = 0.011875

Implied forward rate is therefore 1.4415 x (1+0.014375)/(1+0.011875) = 1.4451

22 45,469

X will be looking to buy USD so the starting point is the spot rate of 1.5425

You need to subtract a premium so the forward rate = 1.5425 – 0.0030 = 1.5395

GBP cost = 70,000/1.5395 = 45,469.

276