Page 287 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 287

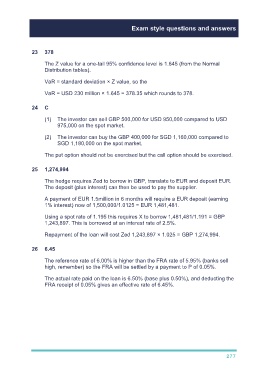

Exam style questions and answers

23 378

The Z value for a one-tail 95% confidence level is 1.645 (from the Normal

Distribution tables).

VaR = standard deviation × Z value, so the

VaR = USD 230 million × 1.645 = 378.35 which rounds to 378.

24 C

(1) The investor can sell GBP 500,000 for USD 950,000 compared to USD

975,000 on the spot market.

(2) The investor can buy the GBP 400,000 for SGD 1,160,000 compared to

SGD 1,180,000 on the spot market.

The put option should not be exercised but the call option should be exercised.

25 1,274,994

The hedge requires Zed to borrow in GBP, translate to EUR and deposit EUR.

The deposit (plus interest) can then be used to pay the supplier.

A payment of EUR 1.5million in 6 months will require a EUR deposit (earning

1% interest) now of 1,500,000/1.0125 = EUR 1,481,481.

Using a spot rate of 1.195 this requires X to borrow 1,481,481/1.191 = GBP

1,243,897. This is borrowed at an interest rate of 2.5%.

Repayment of the loan will cost Zed 1,243,897 × 1.025 = GBP 1,274,994.

26 6.45

The reference rate of 6.00% is higher than the FRA rate of 5.95% (banks sell

high, remember) so the FRA will be settled by a payment to P of 0.05%.

The actual rate paid on the loan is 6.50% (base plus 0.50%), and deducting the

FRA receipt of 0.05% gives an effective rate of 6.45%.

277