Page 292 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 292

Appendix 2

45 A, B,

By paying poorly they are creating motive and by taking little action against their

employees they encouraging dishonesty. It is well known they pay poorly it is

likely that more dishonest individuals will apply thinking they could attempt to

supplement their income fraudulently.

In theory the opportunity is limited by the strong internal controls, so this is not

correct.

Options C, D & E are not pre-requisites of fraud.

46 B

The CIMA guidance for ethical conflict resolution is:

1)Check facts, 2)Escalate internally, 3)Escalate externally, 4)Remove yourself

As a CIMA member it would be ok for her to contact them for advice so option 2

represents the best order.

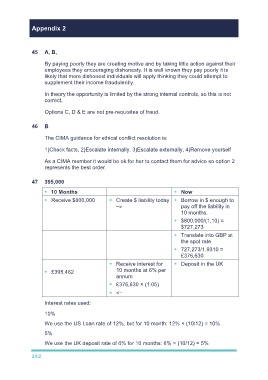

47 395,000

10 Months Now

Receive $800,000 Create $ liability today Borrow in $ enough to

–> pay off the liability in

10 months.

$800,000/(1.10) =

$727,273

Translate into GBP at

the spot rate

727,273/1.9310 =

£376,630

Receive interest for Deposit in the UK

£395,462 10 months at 6% per

annum

£376,630 × (1.05)

<–

Interest rates used:

10%

We use the US Loan rate of 12%, but for 10 month: 12% × (10/12) = 10%

5%

We use the UK deposit rate of 6% for 10 months: 6% × (10/12) = 5%

282