Page 119 - BA2 Integrated Workbook - Student 2017

P. 119

Standard costing and variance analysis

Analysing variances

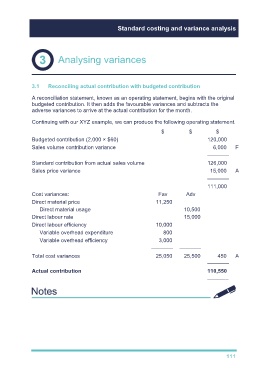

3.1 Reconciling actual contribution with budgeted contribution

A reconciliation statement, known as an operating statement, begins with the original

budgeted contribution. It then adds the favourable variances and subtracts the

adverse variances to arrive at the actual contribution for the month.

Continuing with our XYZ example, we can produce the following operating statement.

$ $ $

Budgeted contribution (2,000 × $60) 120,000

Sales volume contribution variance 6,000 F

————

Standard contribution from actual sales volume 126,000

Sales price variance 15,000 A

————

111,000

Cost variances: Fav Adv

Direct material price 11,250

Direct material usage 10,500

Direct labour rate 15,000

Direct labour efficiency 10,000

Variable overhead expenditure 800

Variable overhead efficiency 3,000

———— ————

Total cost variances 25,050 25,500 450 A

————

Actual contribution 110,550

–––––––

111