Page 5 - AB INBEV 2018 Case Study 2

P. 5

P a g e | 4

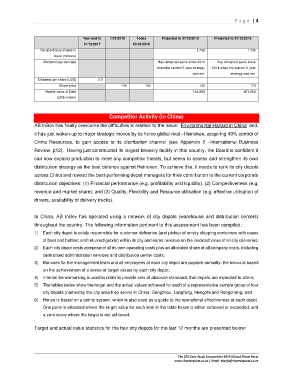

Year end to 1/01/2018 Today Projected to 31/12/2018 Projected to 31/12/2019

31/12/2017 03/10/2018

No of ordinary shares in 1,736 1,736

issue (millions)

Dividend pay-out ratio Has remained same since 2014 Has remained same since

when the current 5-year strategy 2014 when the current 5-year

was set. strategy was set.

Dividend per share (US$) 2.2

Share price 115 132 145 170

Market value of Debt 145,890 301,260

(US$ million)

Competitor Activity (in China)

AB InBev has finally overcome the difficulties in relation to the issue: ‘Environmental Hazard in China’ and,

it has just woken-up to major strategic moves by its fierce global rival –Heineken, acquiring 40% control of

China Resources, to gain access to its distribution channel (see Appendix 2 –International Business

Review, p12). Having just constructed its largest brewery facility in that country, the Board is confident it

can now expand production to meet any competitor threats, but seeks to assess and strengthen its own

distribution strategy as the best defence against Heineken. To achieve this, it needs to rank its city depots

across China and reward the best-performing depot managers for their contribution to the current corporate

distribution objectives: (1) Financial performance (e.g. profitability and liquidity); (2) Competitiveness (e.g.

revenue and market share); and (3) Quality, Flexibility and Resource utilisation (e.g. effective utilisation of

drivers, availability of delivery trucks).

In China, AB InBev has operated using a network of city depots (warehouse and distribution centers)

throughout the country. The following information pertinent to this assessment has been compiled:

1) Each city depot is solely responsible for customer deliveries (and pickup of empty shipping containers with cases

of beer and bottles; and returned goods) within its city and earns revenue on the invoiced value of all city deliveries;

2) Each city depot costs comprise of all its own operating costs plus an allocated share of all company costs, including

centralised administration services and distribution center costs;

3) Bonuses for the management team and all employees at each city depot are payable annually: the bonus is based

on the achievement of a series of target values by each city depot;

4) Internal benchmarking is used in order to provide sets of absolute standards that depots are expected to attain;

5) The tables below show the target and the actual values achieved for each of a representative sample group of four

city depots (named by the city area they serve) in China: Dengzhou, Langfang, Mengzhi and Rongcheng; and

6) Bonus is based on a points system, which is also used as a guide to the operational effectiveness at each depot.

One point is allocated where the target value for each item in the table below is either achieved or exceeded, and

a zero score where the target is not achieved.

Target and actual value statistics for the four city depots for the last 12 months are presented below:

The CFO Case Study Competition 2018 (Grand Finale Pack)

www.charterquest.co.za | Email: thecfo@charterquest.co.za