Page 444 - SBR Integrated Workbook STUDENT S18-J19

P. 444

Chapter 25

Example 13

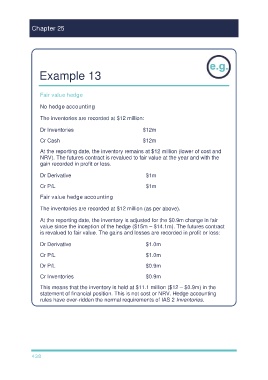

Fair value hedge

No hedge accounting

The inventories are recorded at $12 million:

Dr Inventories $12m

Cr Cash $12m

At the reporting date, the inventory remains at $12 million (lower of cost and

NRV). The futures contract is revalued to fair value at the year and with the

gain recorded in profit or loss.

Dr Derivative $1m

Cr P/L $1m

Fair value hedge accounting

The inventories are recorded at $12 million (as per above).

At the reporting date, the inventory is adjusted for the $0.9m change in fair

value since the inception of the hedge ($15m – $14.1m). The futures contract

is revalued to fair value. The gains and losses are recorded in profit or loss:

Dr Derivative $1.0m

Cr P/L $1.0m

Dr P/L $0.9m

Cr Inventories $0.9m

This means that the inventory is held at $11.1 million ($12 – $0.9m) in the

statement of financial position. This is not cost or NRV. Hedge accounting

rules have over-ridden the normal requirements of IAS 2 Inventories.

438