Page 448 - SBR Integrated Workbook STUDENT S18-J19

P. 448

Chapter 25

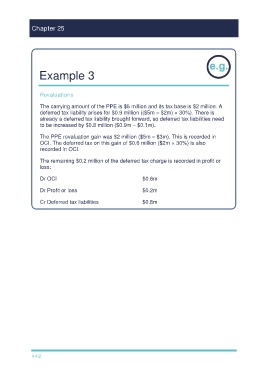

Example 3

Revaluations

The carrying amount of the PPE is $5 million and its tax base is $2 million. A

deferred tax liability arises for $0.9 million (($5m – $2m) × 30%). There is

already a deferred tax liability brought forward, so deferred tax liabilities need

to be increased by $0.8 million ($0.9m – $0.1m).

The PPE revaluation gain was $2 million ($5m – $3m). This is recorded in

OCI. The deferred tax on this gain of $0.6 million ($2m × 30%) is also

recorded in OCI.

The remaining $0.2 million of the deferred tax charge is recorded in profit or

loss:

Dr OCI $0.6m

Dr Profit or loss $0.2m

Cr Deferred tax liabilities $0.8m

442