Page 446 - SBR Integrated Workbook STUDENT S18-J19

P. 446

Chapter 25

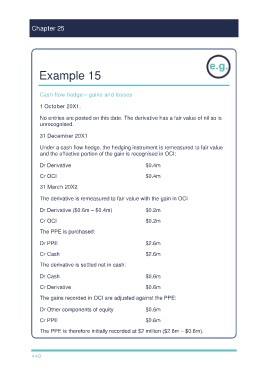

Example 15

Cash flow hedge – gains and losses

1 October 20X1.

No entries are posted on this date. The derivative has a fair value of nil so is

unrecognised.

31 December 20X1

Under a cash flow hedge, the hedging instrument is remeasured to fair value

and the effective portion of the gain is recognised in OCI:

Dr Derivative $0.4m

Cr OCI $0.4m

31 March 20X2

The derivative is remeasured to fair value with the gain in OCI

Dr Derivative ($0.6m – $0.4m) $0.2m

Cr OCI $0.2m

The PPE is purchased:

Dr PPE $2.6m

Cr Cash $2.6m

The derivative is settled net in cash:

Dr Cash $0.6m

Cr Derivative $0.6m

The gains recorded in OCI are adjusted against the PPE:

Dr Other components of equity $0.6m

Cr PPE $0.6m

The PPE is therefore initially recorded at $2 million ($2.6m – $0.6m).

440