Page 196 - Microsoft Word - 00 P1 IW Prelims.docx

P. 196

Chapter 12

Synergy

2.1 Definition of synergy

Synergy may be defined as two or more entities coming together to

produce a result not independently obtainable.

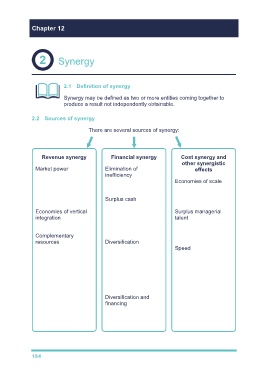

2.2 Sources of synergy

There are several sources of synergy:

Revenue synergy Financial synergy Cost synergy and

other synergistic

Market power – Elimination of effects

horizontal combinations inefficiency – If the

may give monopoly victim company is badly Economies of scale –

power that can increase managed. can occur in the

profitability (but beware production, marketing

competition authorities). Surplus cash – or finance areas.

acquisition uses surplus

Economies of vertical cash if increased Surplus managerial

integration – 'cutting out dividends are not talent – the acquisition

the middle man'. considered to be of inefficient companies

appropriate. is a good way to utilise

Complementary skilled managers.

resources – e.g. Diversification –

combining an R&D reduces risk, so even if Speed – acquisition is

company with a the earnings stay the usually much faster

company strong in same (i.e. no operating than organic growth.

marketing could lead to economies), there

gains. could still be an

increase in value of the

company.

Diversification and

financing – variability of

operating cash flows

may be reduced - more

attractive to lenders.

184