Page 28 - MCS August Day 1 Suggested Solutions

P. 28

CIMA AUGUST 2018 – MANAGEMENT CASE STUDY

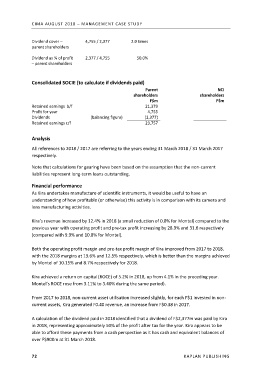

Dividend cover – 4,755 / 2,377 2.0 times

parent shareholders

Dividend as % of profit 2,377 / 4,755 50.0%

– parent shareholders

Consolidated SOCIE (to calculate if dividends paid)

Parent NCI

shareholders shareholders

F$m F$m

Retained earnings b/f 21,379

Profit for year 4,755

Dividends (balancing figure) (2,377)

Retained earnings c/f 23,757

Analysis

All references to 2018 / 2017 are referring to the years ending 31 March 2018 / 31 March 2017

respectively.

Note that calculations for gearing have been based on the assumption that the non‐current

liabilities represent long‐term loans outstanding.

Financial performance

As Kira undertakes manufacture of scientific instruments, it would be useful to have an

understanding of how profitable (or otherwise) this activity is in comparison with its camera and

lens manufacturing activities.

Kira’s revenue increased by 12.4% in 2018 (a small reduction of 0.8% for Montel) compared to the

previous year with operating profit and pre‐tax profit increasing by 28.9% and 31.6 respectively

(compared with 9.9% and 10.8% for Montel).

Both the operating profit margin and pre‐tax profit margin of Kira improved from 2017 to 2018,

with the 2018 margins at 13.6% and 12.5% respectively, which is better than the margins achieved

by Montel of 10.15% and 8.7% respectively for 2018.

Kira achieved a return on capital (ROCE) of 5.2% in 2018, up from 4.1% in the preceding year.

Montel’s ROCE rose from 3.11% to 3.40% during the same period).

From 2017 to 2018, non‐current asset utilisation increased slightly, for each F$1 invested in non‐

current assets, Kira generated F0.40 revenue, an increase from F$0.38 in 2017.

A calculation of the dividend paid in 2018 identified that a dividend of F$2,377m was paid by Kira

in 2018, representing approximately 50% of the profit after tax for the year. Kira appears to be

able to afford these payments from a cash perspective as it has cash and equivalent balances of

over F$900m at 31 March 2018.

72 KAPLAN PUBLISHING