Page 27 - MCS August Day 1 Suggested Solutions

P. 27

SUGGESTED SOLUTIONS

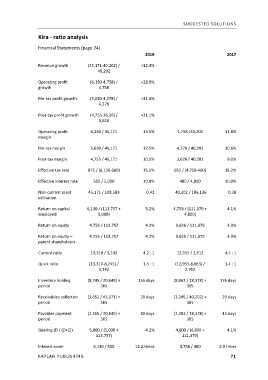

Kira ‐ ratio analysis

Financial Statements (page 24)

2018 2017

Revenue growth (45,171‐40,202) / +12.4%

40,202

Operating profit (6,130‐4,758) / +28.9%

growth 4,758

Pre‐tax profit growth (5,630‐4,278) / +31.6%

4,278

Post‐tax profit growth (4,755‐36,26) / +31.1%

3,626

Operating profit 6,130 / 45,171 13.6% 4,758 /40,202 11.8%

margin

Pre‐tax margin 5,630 / 45,171 12.5% 4,278 / 40,202 10.6%

Post‐tax margin 4,755 / 45,171 10.5% 3,626 / 40,202 9.0%

Effective tax rate 875 / (6,130‐500) 15.5% 652 / (4,758‐480) 15.2%

Effective interest rate 500 / 5,000 10.0% 480 / 4,800 10.0%

Non‐current asset 45,171 / 108,589 0.42 40,202 / 106,136 0.38

utilisation

Return on capital 6,130 / (113,757 + 5.2% 4,758 / (111,379 + 4.1%

employed 5,000) 4,800)

Return on equity 4,755 / 113,757 4.2% 3,626 / 111,379 3.3%

Return on equity – 4,755 / 113,757 4.2% 3,626 / 111,379 3.3%

parent shareholders

Current ratio 13,310 / 3,142 4.2 : 1 12,955 / 2,912 4.5 : 1

Quick ratio (13,310‐8,745) / 1.5 : 1 (12,955‐8,863) / 1.4 : 1

3,142 2,912

Inventory holding (8,745 / 20,649) × 155 days (8,863 / 18,378) × 176 days

period 365 365

Receivables collection (3,652 / 45,171) × 29 days (3,245 / 40,202) × 29 days

period 365 365

Payables payment (2,265 / 20,649) × 40 days (2,283 / 18,378) × 45 days

period 365 365

Gearing (D / (D+E)) 5,000 / (5,000 + 4.2% 4,800 / (4,800 + 4.1%

113,757) 111,379)

Interest cover 6,130 / 500 12.2.times 4,758 / 480 9.9 times

KAPLAN PUBLISHING 71