Page 22 - MCS August Day 1 Suggested Solutions

P. 22

CIMA AUGUST 2018 – MANAGEMENT CASE STUDY

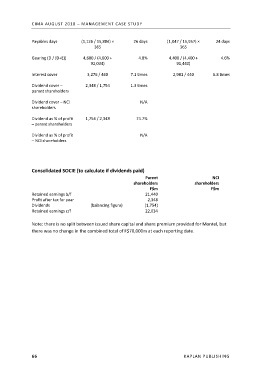

Payables days (1,126 / 15,884) × 26 days (1,047 / 15,957) × 24 days

365 365

Gearing (D / (D+E)) 4,600 / (4,600 + 4.8% 4,400 / (4,400 + 4.6%

92,034) 91,440)

Interest cover 3,276 / 460 7.1 times 2,981 / 440 6.8 times

Dividend cover – 2,348 / 1,754 1.3 times

parent shareholders

Dividend cover – NCI N/A

shareholders

Dividend as % of profit 1,754 / 2,348 74.7%

– parent shareholders

Dividend as % of profit N/A

– NCI shareholders

Consolidated SOCIE (to calculate if dividends paid)

Parent NCI

shareholders shareholders

F$m F$m

Retained earnings b/f 21,440

Profit after tax for year 2,348

Dividends (balancing figure) (1,754)

Retained earnings c/f 22,034

Note: there is no split between issued share capital and share premium provided for Montel, but

there was no change in the combined total of F$70,000m at each reporting date.

66 KAPLAN PUBLISHING