Page 21 - MCS August Day 1 Suggested Solutions

P. 21

SUGGESTED SOLUTIONS

CHAPTER SIX

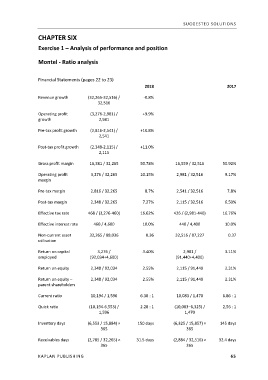

Exercise 1 – Analysis of performance and position

Montel ‐ Ratio analysis

Financial Statements (pages 22 to 23)

2018 2017

Revenue growth (32,265‐32,516) / ‐0.8%

32,516

Operating profit (3,276‐2,981) / +9.9%

growth 2,981

Pre‐tax profit growth (2,816‐2,541) / +10.8%

2,541

Post‐tax profit growth (2,348‐2,115) / +11.0%

2,115

Gross profit margin 16,381 / 32,265 50.78% 16,559 / 32,516 50.92%

Operating profit 3,276 / 32,265 10.15% 2,981 / 32,516 9.17%

margin

Pre‐tax margin 2,816 / 32,265 8.7% 2,541 / 32,516 7,8%

Post‐tax margin 2,348 / 32,265 7.27% 2,115 / 32,516 6.50%

Effective tax rate 468 / (3,276‐460) 16.62% 426 / (2,981‐440) 16.76%

Effective interest rate 460 / 4,600 10.0% 440 / 4,400 10.0%

Non‐current asset 32,265 / 88,036 0.36 32,516 / 87,227 0.37

utilisation

Return on capital 3,276 / 3.40% 2,981 / 3.11%

employed (92,034+4,600) (91,440+4,400)

Return on equity 2,348 / 92,034 2.55% 2,115 / 91,440 2.31%

Return on equity – 2,348 / 92,034 2.55% 2,115 / 91,440 2.31%

parent shareholders

Current ratio 10,194 / 1,596 6.38 : 1 10,083 / 1,470 6.86 : 1

Quick ratio (10,194‐6,553) / 2.28 : 1 (10,083–6,325) / 2,56 : 1

1,596 1,470

Inventory days (6,553 / 15,884) × 150 days (6,325 / 15,857) × 145 days

365 365

Receivables days (2,785 / 32,265) × 31.5 days (2,884 / 32,516) × 32.4 days

365 365

KAPLAN PUBLISHING 65