Page 3 - P6 Slide Taxation - Lecture Day 3 - VAT Part 2

P. 3

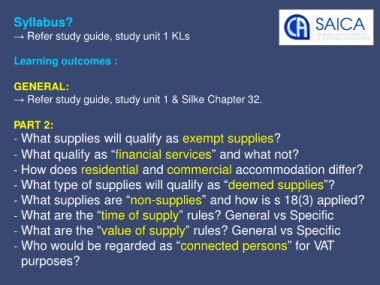

Syllabus?

→ Refer study guide, study unit 1 KLs

Learning outcomes :

GENERAL:

→ Refer study guide, study unit 1 & Silke Chapter 32.

PART 2:

- What supplies will qualify as exempt supplies?

- What qualify as “financial services” and what not?

- How does residential and commercial accommodation differ?

- What type of supplies will qualify as “deemed supplies”?

- What supplies are “non-supplies” and how is s 18(3) applied?

- What are the “time of supply” rules? General vs Specific

- What are the “value of supply” rules? General vs Specific

- Who would be regarded as “connected persons” for VAT

purposes?