Page 6 - P6 Slide Taxation - Lecture Day 3 - VAT Part 2

P. 6

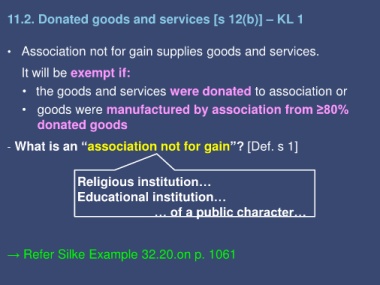

11.2. Donated goods and services [s 12(b)] – KL 1

• Association not for gain supplies goods and services.

It will be exempt if:

• the goods and services were donated to association or

• goods were manufactured by association from ≥80%

donated goods

- What is an “association not for gain”? [Def. s 1]

Religious institution…

Educational institution…

… of a public character…

→ Refer Silke Example 32.20.on p. 1061