Page 9 - P6 Slide Taxation - Lecture Day 3 - VAT Part 2

P. 9

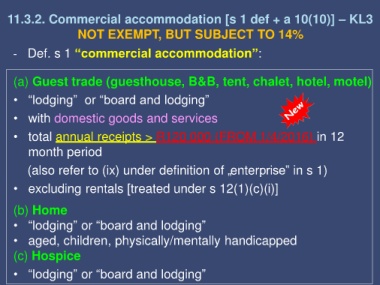

11.3.2. Commercial accommodation [s 1 def + a 10(10)] – KL3

NOT EXEMPT, BUT SUBJECT TO 14%

- Def. s 1 “commercial accommodation”:

(a) Guest trade (guesthouse, B&B, tent, chalet, hotel, motel)

• “lodging” or “board and lodging”

• with domestic goods and services

• total annual receipts > R120 000 (FROM 1/4/2016) in 12

month period

(also refer to (ix) under definition of „enterprise‟ in s 1)

• excluding rentals [treated under s 12(1)(c)(i)]

(b) Home

• “lodging” or “board and lodging”

• aged, children, physically/mentally handicapped

(c) Hospice

• “lodging” or “board and lodging”