Page 13 - P6 Slide Taxation - Lecture Day 3 - VAT Part 2

P. 13

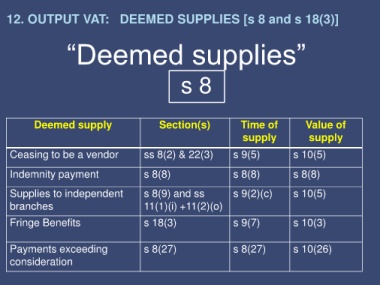

12. OUTPUT VAT: DEEMED SUPPLIES [s 8 and s 18(3)]

“Deemed supplies”

s 8

Deemed supply Section(s) Time of Value of

supply supply

Ceasing to be a vendor ss 8(2) & 22(3) s 9(5) s 10(5)

Indemnity payment s 8(8) s 8(8) s 8(8)

Supplies to independent s 8(9) and ss s 9(2)(c) s 10(5)

branches 11(1)(i) +11(2)(o)

Fringe Benefits s 18(3) s 9(7) s 10(3)

Payments exceeding s 8(27) s 8(27) s 10(26)

consideration