Page 15 - P6 Slide Taxation - Lecture Day 3 - VAT Part 2

P. 15

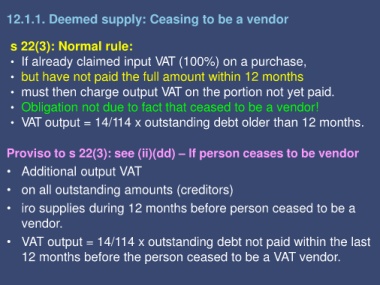

12.1.1. Deemed supply: Ceasing to be a vendor

s 22(3): Normal rule:

• If already claimed input VAT (100%) on a purchase,

• but have not paid the full amount within 12 months

• must then charge output VAT on the portion not yet paid.

• Obligation not due to fact that ceased to be a vendor!

• VAT output = 14/114 x outstanding debt older than 12 months.

Proviso to s 22(3): see (ii)(dd) – If person ceases to be vendor

• Additional output VAT

• on all outstanding amounts (creditors)

• iro supplies during 12 months before person ceased to be a

vendor.

• VAT output = 14/114 x outstanding debt not paid within the last

12 months before the person ceased to be a VAT vendor.