Page 20 - P6 Slide Taxation - Lecture Day 3 - VAT Part 2

P. 20

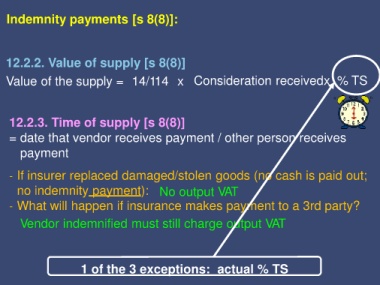

Indemnity payments [s 8(8)]:

12.2.2. Value of supply [s 8(8)]

Value of the supply = 14/114 x Consideration receivedx % TS

12.2.3. Time of supply [s 8(8)]

= date that vendor receives payment / other person receives

payment

- If insurer replaced damaged/stolen goods (no cash is paid out;

no indemnity payment): No output VAT

- What will happen if insurance makes payment to a 3rd party?

Vendor indemnified must still charge output VAT

1 of the 3 exceptions: actual % TS