Page 16 - P6 Slide Taxation - Lecture Day 3 - VAT Part 2

P. 16

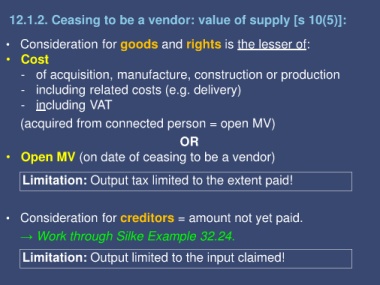

12.1.2. Ceasing to be a vendor: value of supply [s 10(5)]:

• Consideration for goods and rights is the lesser of:

• Cost

- of acquisition, manufacture, construction or production

- including related costs (e.g. delivery)

- including VAT

(acquired from connected person = open MV)

OR

• Open MV (on date of ceasing to be a vendor)

Limitation: Output tax limited to the extent paid!

• Consideration for creditors = amount not yet paid.

→ Work through Silke Example 32.24.

Limitation: Output limited to the input claimed!