Page 14 - P6 Slide Taxation - Lecture Day 3 - VAT Part 2

P. 14

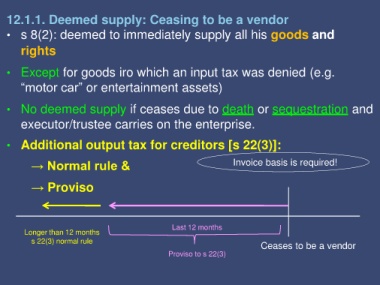

12.1.1. Deemed supply: Ceasing to be a vendor

• s 8(2): deemed to immediately supply all his goods and

rights

• Except for goods iro which an input tax was denied (e.g.

“motor car” or entertainment assets)

• No deemed supply if ceases due to death or sequestration and

executor/trustee carries on the enterprise.

• Additional output tax for creditors [s 22(3)]:

→ Normal rule & Invoice basis is required!

→ Proviso

Last 12 months

Longer than 12 months

s 22(3) normal rule

Ceases to be a vendor

Proviso to s 22(3)