Page 8 - P6 Slide Taxation - Lecture Day 3 - VAT Part 2

P. 8

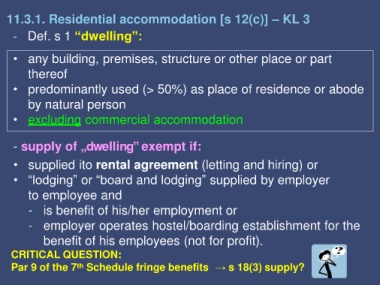

11.3.1. Residential accommodation [s 12(c)] – KL 3

- Def. s 1 “dwelling”:

• any building, premises, structure or other place or part

thereof

• predominantly used (> 50%) as place of residence or abode

by natural person

• excluding commercial accommodation

- supply of „ d wellin g ‟ exempt if:

• supplied ito rental agreement (letting and hiring) or

• “lodging” or “board and lodging” supplied by employer

to employee and

- is benefit of his/her employment or

- employer operates hostel/boarding establishment for the

benefit of his employees (not for profit).

CRITICAL QUESTION:

Par 9 of the 7 Schedule fringe benefits → s 18(3) supply?

th