Page 4 - P6 Slide Taxation - Lecture Day 3 - VAT Part 2

P. 4

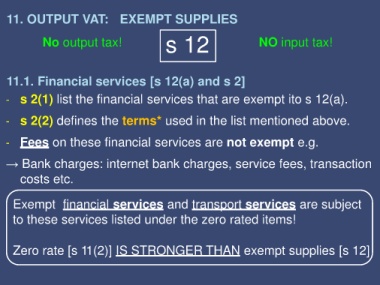

11. OUTPUT VAT: EXEMPT SUPPLIES

No output tax! s 12 NO input tax!

11.1. Financial services [s 12(a) and s 2]

- s 2(1) list the financial services that are exempt ito s 12(a).

- s 2(2) defines the terms* used in the list mentioned above.

- Fees on these financial services are not exempt e.g.

→ Bank charges: internet bank charges, service fees, transaction

costs etc.

Exempt financial services and transport services are subject

to these services listed under the zero rated items!

Zero rate [s 11(2)] IS STRONGER THAN exempt supplies [s 12]