Page 4 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 4

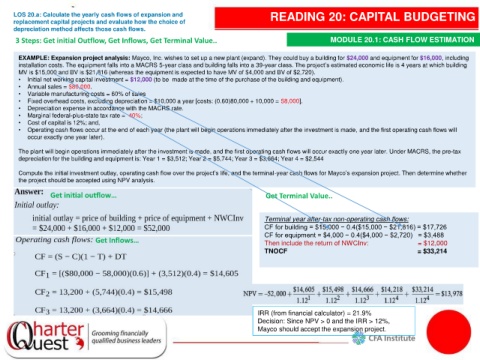

LOS 20.a: Calculate the yearly cash flows of expansion and READING 20: CAPITAL BUDGETING

replacement capital projects and evaluate how the choice of

depreciation method affects those cash flows.

3 Steps: Get initial Outflow, Get Inflows, Get Terminal Value.. MODULE 20.1: CASH FLOW ESTIMATION

EXAMPLE: Expansion project analysis: Mayco, Inc. wishes to set up a new plant (expand). They could buy a building for $24,000 and equipment for $16,000, including

installation costs. The equipment falls into a MACRS 5-year class and building falls into a 39-year class. The project’s estimated economic life is 4 years at which building

MV is $15,000 and BV is $21,816 (whereas the equipment is expected to have MV of $4,000 and BV of $2,720).

• Initial net working capital investment = $12,000 (to be made at the time of the purchase of the building and equipment).

• Annual sales = $80,000.

• Variable manufacturing costs = 60% of sales

• Fixed overhead costs, excluding depreciation = $10,000 a year [costs: (0.60)80,000 + 10,000 = 58,000].

• Depreciation expense in accordance with the MACRS rate.

• Marginal federal-plus-state tax rate = 40%;

• Cost of capital is 12%; and,

• Operating cash flows occur at the end of each year (the plant will begin operations immediately after the investment is made, and the first operating cash flows will

occur exactly one year later).

The plant will begin operations immediately after the investment is made, and the first operating cash flows will occur exactly one year later. Under MACRS, the pre-tax

depreciation for the building and equipment is: Year 1 = $3,512; Year 2 = $5,744; Year 3 = $3,664; Year 4 = $2,544

Compute the initial investment outlay, operating cash flow over the project’s life, and the terminal-year cash flows for Mayco’s expansion project. Then determine whether

the project should be accepted using NPV analysis.

Get initial outflow… Get Terminal Value..

Terminal year after-tax non-operating cash flows:

CF for building = $15,000 − 0.4($15,000 − $21,816) = $17,726

CF for equipment = $4,000 − 0.4($4,000 − $2,720) = $3,488

Get Inflows… Then include the return of NWCInv: = $12,000

TNOCF = $33,214

IRR (from financial calculator) = 21.9%

Decision: Since NPV > 0 and the IRR > 12%,

Mayco should accept the expansion project.