Page 9 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 9

LOS 20.d: Explain how sensitivity analysis, scenario analysis,

and Monte Carlo simulation can be used to assess the stand- READING 20: CAPITAL BUDGETING

alone risk of a capital project.

Sensitivity analysis involves changing an input (independent) variable to MODULE 20.2: EVALUATION OF PROJECTS AND DISCOUNT RATE ESTIMATION

see how sensitive the dependent variable (NPV) is to the input variable.

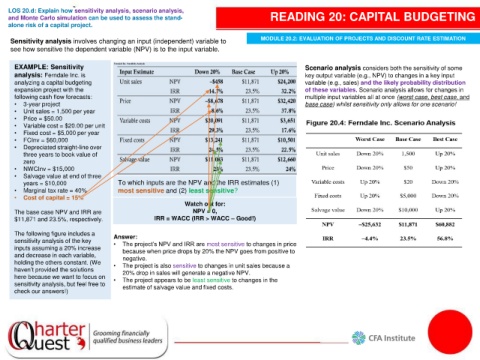

EXAMPLE: Sensitivity Scenario analysis considers both the sensitivity of some

analysis: Ferndale Inc. is key output variable (e.g., NPV) to changes in a key input

analyzing a capital budgeting variable (e.g., sales) and the likely probability distribution

expansion project with the of these variables. Scenario analysis allows for changes in

following cash flow forecasts: multiple input variables all at once (worst case, best case, and

• 3-year project base case) whilst sensitivity only allows for one scenario!

• Unit sales = 1,500 per year

• Price = $50.00

• Variable cost = $20.00 per unit

• Fixed cost = $5,000 per year

• FCInv = $60,000

• Depreciated straight-line over

three years to book value of

zero

• NWCInv = $15,000

• Salvage value at end of three

years = $10,000 To which inputs are the NPV and the IRR estimates (1)

• Marginal tax rate = 40% most sensitive and (2) least sensitive?

• Cost of capital = 15%

Watch out for:

The base case NPV and IRR are NPV = 0,

$11,871 and 23.5%, respectively. IRR = WACC (IRR > WACC – Good!)

The following figure includes a Answer:

sensitivity analysis of the key • The project’s NPV and IRR are most sensitive to changes in price

inputs assuming a 20% increase because when price drops by 20% the NPV goes from positive to

and decrease in each variable, negative.

holding the others constant. (We • The project is also sensitive to changes in unit sales because a

haven’t provided the solutions 20% drop in sales will generate a negative NPV.

here because we want to focus on • The project appears to be least sensitive to changes in the

sensitivity analysis, but feel free to estimate of salvage value and fixed costs.

check our answers!)