Page 7 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 7

READING 20: CAPITAL BUDGETING

LOS 20.b: Explain how inflation affects

capital budgeting analysis.

MODULE 20.1: CASH FLOW ESTIMATION

1. Analyzing nominal or real cash flows : Nominal cash flows discounted at a nominal discount rate, and real cash flows at real discount rate.

2. Changes in inflation affect project profitability: If higher, future project CFs are worth less, and project value is lower (reverse is true);

3. Inflation reduces the tax savings from depreciation: If higher, real taxes paid are increased because the depreciation tax shelter is less valuable as

this charge which is based upon the asset’s purchase price, is less than it would be if recalculated at current (i.e., inflated) prices.

4. Inflation decreases the value of payments to bondholders: Higher than expected inflation shifts wealth to issuing firms at bondholders’ expense.

5. Inflation may affect revenues and costs differently.

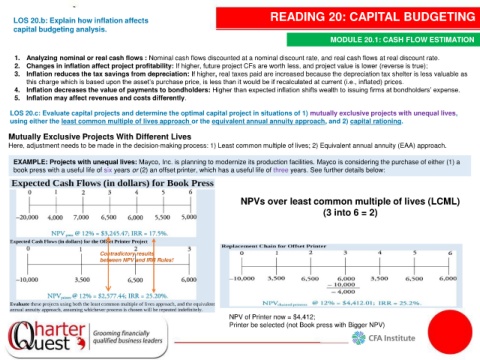

LOS 20.c: Evaluate capital projects and determine the optimal capital project in situations of 1) mutually exclusive projects with unequal lives,

using either the least common multiple of lives approach or the equivalent annual annuity approach, and 2) capital rationing.

Mutually Exclusive Projects With Different Lives

Here, adjustment needs to be made in the decision-making process: 1) Least common multiple of lives; 2) Equivalent annual annuity (EAA) approach.

EXAMPLE: Projects with unequal lives: Mayco, Inc. is planning to modernize its production facilities. Mayco is considering the purchase of either (1) a

book press with a useful life of six years or (2) an offset printer, which has a useful life of three years. See further details below:

NPVs over least common multiple of lives (LCML)

(3 into 6 = 2)

Contradictory results

between NPV and IRR Rules!

NPV of Printer now = $4,412;

Printer be selected (not Book press with Bigger NPV)