Page 11 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 11

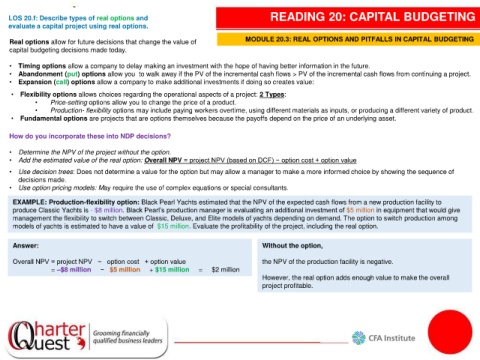

LOS 20.f: Describe types of real options and READING 20: CAPITAL BUDGETING

evaluate a capital project using real options.

Real options allow for future decisions that change the value of MODULE 20.3: REAL OPTIONS AND PITFALLS IN CAPITAL BUDGETING

capital budgeting decisions made today.

• Timing options allow a company to delay making an investment with the hope of having better information in the future.

• Abandonment (put) options allow you to walk away if the PV of the incremental cash flows > PV of the incremental cash flows from continuing a project.

• Expansion (call) options allow a company to make additional investments if doing so creates value:

• Flexibility options allows choices regarding the operational aspects of a project: 2 Types:

• Price-setting options allow you to change the price of a product.

• Production- flexibility options may include paying workers overtime, using different materials as inputs, or producing a different variety of product.

• Fundamental options are projects that are options themselves because the payoffs depend on the price of an underlying asset.

How do you incorporate these into NDP decisions?

• Determine the NPV of the project without the option.

• Add the estimated value of the real option: Overall NPV = project NPV (based on DCF) − option cost + option value

• Use decision trees: Does not determine a value for the option but may allow a manager to make a more informed choice by showing the sequence of

decisions made.

• Use option pricing models: May require the use of complex equations or special consultants.

EXAMPLE: Production-flexibility option: Black Pearl Yachts estimated that the NPV of the expected cash flows from a new production facility to

produce Classic Yachts is - $8 million. Black Pearl’s production manager is evaluating an additional investment of $5 million in equipment that would give

management the flexibility to switch between Classic, Deluxe, and Elite models of yachts depending on demand. The option to switch production among

models of yachts is estimated to have a value of $15 million. Evaluate the profitability of the project, including the real option.

Answer: Without the option,

Overall NPV = project NPV − option cost + option value the NPV of the production facility is negative.

= –$8 million − $5 million + $15 million = $2 million

However, the real option adds enough value to make the overall

project profitable.