Page 12 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 12

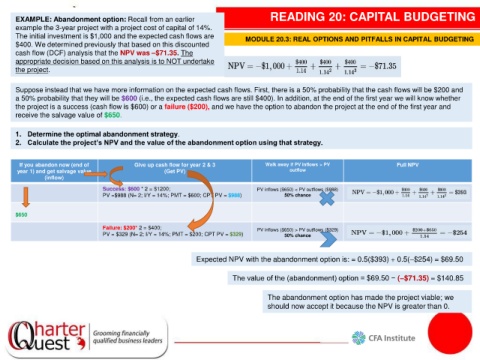

EXAMPLE: Abandonment option: Recall from an earlier READING 20: CAPITAL BUDGETING

example the 3-year project with a project cost of capital of 14%.

The initial investment is $1,000 and the expected cash flows are MODULE 20.3: REAL OPTIONS AND PITFALLS IN CAPITAL BUDGETING

$400. We determined previously that based on this discounted

cash flow (DCF) analysis that the NPV was –$71.35. The

appropriate decision based on this analysis is to NOT undertake

the project.

Suppose instead that we have more information on the expected cash flows. First, there is a 50% probability that the cash flows will be $200 and

a 50% probability that they will be $600 (i.e., the expected cash flows are still $400). In addition, at the end of the first year we will know whether

the project is a success (cash flow is $600) or a failure ($200), and we have the option to abandon the project at the end of the first year and

receive the salvage value of $650.

1. Determine the optimal abandonment strategy.

2. Calculate the project’s NPV and the value of the abandonment option using that strategy.

If you abandon now (end of Give up cash flow for year 2 & 3 Walk away if PV inflows > PV Full NPV

year 1) and get salvage value (Get PV) outflow

(inflow)

Success: $600 * 2 = $1200; PV inflows ($650) < PV outflows ($988)

PV =$988 (N= 2; I/Y = 14%; PMT = $600; CPT PV = $988) 50% chance

$650

Failure: $200* 2 = $400; PV inflows ($650) > PV outflows ($329)

PV = $329 (N= 2; I/Y = 14%; PMT = $200; CPT PV = $329) 50% chance

Expected NPV with the abandonment option is: = 0.5($393) + 0.5(–$254) = $69.50

The value of the (abandonment) option = $69.50 − (–$71.35) = $140.85

The abandonment option has made the project viable; we

should now accept it because the NPV is greater than 0.