Page 8 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 8

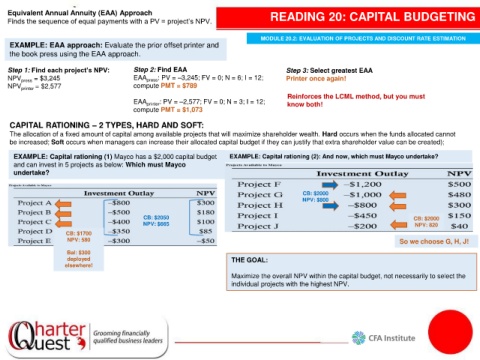

Equivalent Annual Annuity (EAA) Approach READING 20: CAPITAL BUDGETING

Finds the sequence of equal payments with a PV = project’s NPV.

MODULE 20.2: EVALUATION OF PROJECTS AND DISCOUNT RATE ESTIMATION

EXAMPLE: EAA approach: Evaluate the prior offset printer and

the book press using the EAA approach.

Step 1: Find each project’s NPV: Step 2: Find EAA Step 3: Select greatest EAA

NPV press = $3,245 EAA press : PV = –3,245; FV = 0; N = 6; I = 12; Printer once again!

NPV printer = $2,577 compute PMT = $789

Reinforces the LCML method, but you must

EAA printer : PV = –2,577; FV = 0; N = 3; I = 12; know both!

compute PMT = $1,073

CAPITAL RATIONING – 2 TYPES, HARD AND SOFT:

The allocation of a fixed amount of capital among available projects that will maximize shareholder wealth. Hard occurs when the funds allocated cannot

be increased; Soft occurs when managers can increase their allocated capital budget if they can justify that extra shareholder value can be created);

EXAMPLE: Capital rationing (1) Mayco has a $2,000 capital budget EXAMPLE: Capital rationing (2): And now, which must Mayco undertake?

and can invest in 5 projects as below: Which must Mayco

undertake?

CB: $2000

NPV: $800

CB: $2050 CB: $2000

NPV: $665 NPV: 820

CB: $1700

NPV: 580 So we choose G, H, J!

Bal: $300

deployed THE GOAL:

elsewhere!

Maximize the overall NPV within the capital budget, not necessarily to select the

individual projects with the highest NPV.