Page 236 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 236

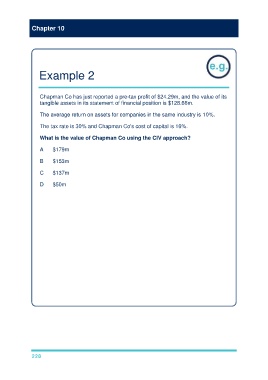

Chapter 10

Example 2

Chapman Co has just reported a pre-tax profit of $24.29m, and the value of its

tangible assets in its statement of financial position is $128.66m.

The average return on assets for companies in the same industry is 10%.

The tax rate is 30% and Chapman Co's cost of capital is 16%.

What is the value of Chapman Co using the CIV approach?

A $179m

B $153m

C $137m

D $50m

Solution

The answer is (A).

$m

Current pre-tax profit 24.29

Less: Industry ROA × Tangible assets (10% × 128.66m) (12.87)

–––––

Excess annual return (pre-tax) 11.42

–––––

Post-tax excess annual return = 11.42m × (1 – 0.30) = $7.99m

CIV (assuming constant perpetuity) = 7.99m × 1/0.16 = $49.94m

Therefore, the total value of Chapman Co is estimated to be

128.66m + 49.94m = $178.60m (i.e. approx. $179m)

228