Page 400 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 400

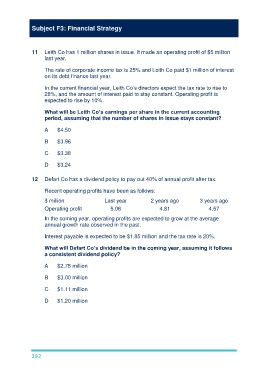

Subject F3: Financial Strategy

11 Leith Co has 1 million shares in issue. It made an operating profit of $5 million

last year.

The rate of corporate income tax is 25% and Leith Co paid $1 million of interest

on its debt finance last year.

In the current financial year, Leith Co’s directors expect the tax rate to rise to

28%, and the amount of interest paid to stay constant. Operating profit is

expected to rise by 10%.

What will be Leith Co’s earnings per share in the current accounting

period, assuming that the number of shares in issue stays constant?

A $4.50

B $3.96

C $3.38

D $3.24

12 Defart Co has a dividend policy to pay out 40% of annual profit after tax.

Recent operating profits have been as follows:

$ million Last year 2 years ago 3 years ago

Operating profit 5.06 4.81 4.57

In the coming year, operating profits are expected to grow at the average

annual growth rate observed in the past.

Interest payable is expected to be $1.85 million and the tax rate is 20%.

What will Defart Co’s dividend be in the coming year, assuming it follows

a consistent dividend policy?

A $2.78 million

B $3.00 million

C $1.11 million

D $1.20 million

392