Page 403 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 403

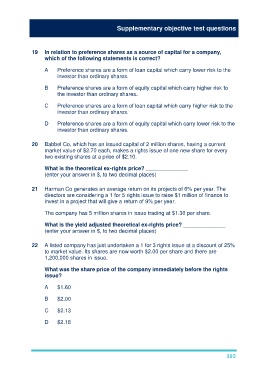

Supplementary objective test questions

19 In relation to preference shares as a source of capital for a company,

which of the following statements is correct?

A Preference shares are a form of loan capital which carry lower risk to the

investor than ordinary shares.

B Preference shares are a form of equity capital which carry higher risk to

the investor than ordinary shares.

C Preference shares are a form of loan capital which carry higher risk to the

investor than ordinary shares.

D Preference shares are a form of equity capital which carry lower risk to the

investor than ordinary shares.

20 Babbel Co, which has an issued capital of 2 million shares, having a current

market value of $2.70 each, makes a rights issue of one new share for every

two existing shares at a price of $2.10.

What is the theoretical ex-rights price? ______________

(enter your answer in $, to two decimal places)

21 Harman Co generates an average return on its projects of 6% per year. The

directors are considering a 1 for 5 rights issue to raise $1 million of finance to

invest in a project that will give a return of 9% per year.

The company has 5 million shares in issue trading at $1.30 per share.

What is the yield adjusted theoretical ex-rights price? ______________

(enter your answer in $, to two decimal places)

22 A listed company has just undertaken a 1 for 3 rights issue at a discount of 25%

to market value. Its shares are now worth $2.00 per share and there are

1,200,000 shares in issue.

What was the share price of the company immediately before the rights

issue?

A $1.60

B $2.00

C $2.13

D $2.18

395