Page 408 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 408

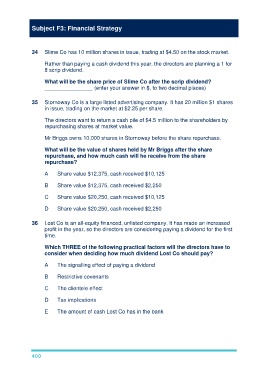

Subject F3: Financial Strategy

34 Slime Co has 10 million shares in issue, trading at $4.50 on the stock market.

Rather than paying a cash dividend this year, the directors are planning a 1 for

8 scrip dividend.

What will be the share price of Slime Co after the scrip dividend?

________________ (enter your answer in $, to two decimal places)

35 Stornoway Co is a large listed advertising company. It has 20 million $1 shares

in issue, trading on the market at $2.25 per share.

The directors want to return a cash pile of $4.5 million to the shareholders by

repurchasing shares at market value.

Mr Briggs owns 10,000 shares in Stornoway before the share repurchase.

What will be the value of shares held by Mr Briggs after the share

repurchase, and how much cash will he receive from the share

repurchase?

A Share value $12,375, cash received $10,125

B Share value $12,375, cash received $2,250

C Share value $20,250, cash received $10,125

D Share value $20,250, cash received $2,250

36 Lost Co is an all-equity financed, unlisted company. It has made an increased

profit in the year, so the directors are considering paying a dividend for the first

time.

Which THREE of the following practical factors will the directors have to

consider when deciding how much dividend Lost Co should pay?

A The signalling effect of paying a dividend

B Restrictive covenants

C The clientele effect

D Tax implications

E The amount of cash Lost Co has in the bank

400