Page 404 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 404

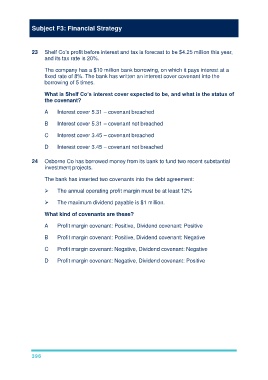

Subject F3: Financial Strategy

23 Shelf Co’s profit before interest and tax is forecast to be $4.25 million this year,

and its tax rate is 20%.

The company has a $10 million bank borrowing, on which it pays interest at a

fixed rate of 8%. The bank has written an interest cover covenant into the

borrowing of 5 times.

What is Shelf Co’s interest cover expected to be, and what is the status of

the covenant?

A Interest cover 5.31 – covenant breached

B Interest cover 5.31 – covenant not breached

C Interest cover 3.45 – covenant breached

D Interest cover 3.45 – covenant not breached

24 Osborne Co has borrowed money from its bank to fund two recent substantial

investment projects.

The bank has inserted two covenants into the debt agreement:

The annual operating profit margin must be at least 12%

The maximum dividend payable is $1 million.

What kind of covenants are these?

A Profit margin covenant: Positive, Dividend covenant: Positive

B Profit margin covenant: Positive, Dividend covenant: Negative

C Profit margin covenant: Negative, Dividend covenant: Negative

D Profit margin covenant: Negative, Dividend covenant: Positive

396