Page 402 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 402

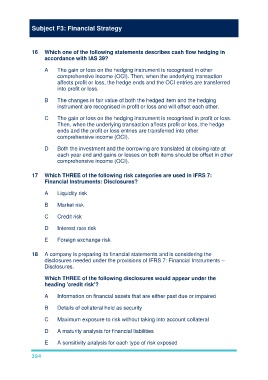

Subject F3: Financial Strategy

16 Which one of the following statements describes cash flow hedging in

accordance with IAS 39?

A The gain or loss on the hedging instrument is recognised in other

comprehensive income (OCI). Then, when the underlying transaction

affects profit or loss, the hedge ends and the OCI entries are transferred

into profit or loss.

B The changes in fair value of both the hedged item and the hedging

instrument are recognised in profit or loss and will offset each other.

C The gain or loss on the hedging instrument is recognised in profit or loss.

Then, when the underlying transaction affects profit or loss, the hedge

ends and the profit or loss entries are transferred into other

comprehensive income (OCI).

D Both the investment and the borrowing are translated at closing rate at

each year end and gains or losses on both items should be offset in other

comprehensive income (OCI).

17 Which THREE of the following risk categories are used in IFRS 7:

Financial Instruments: Disclosures?

A Liquidity risk

B Market risk

C Credit risk

D Interest rate risk

E Foreign exchange risk

18 A company is preparing its financial statements and is considering the

disclosures needed under the provisions of IFRS 7: Financial Instruments –

Disclosures.

Which THREE of the following disclosures would appear under the

heading 'credit risk'?

A Information on financial assets that are either past due or impaired

B Details of collateral held as security

C Maximum exposure to risk without taking into account collateral

D A maturity analysis for financial liabilities

E A sensitivity analysis for each type of risk exposed

394