Page 413 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 413

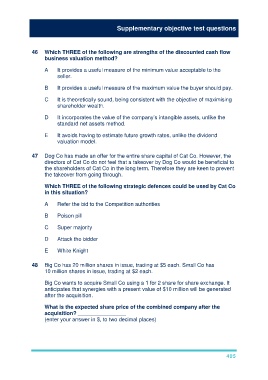

Supplementary objective test questions

46 Which THREE of the following are strengths of the discounted cash flow

business valuation method?

A It provides a useful measure of the minimum value acceptable to the

seller.

B It provides a useful measure of the maximum value the buyer should pay.

C It is theoretically sound, being consistent with the objective of maximising

shareholder wealth.

D It incorporates the value of the company’s intangible assets, unlike the

standard net assets method.

E It avoids having to estimate future growth rates, unlike the dividend

valuation model.

47 Dog Co has made an offer for the entire share capital of Cat Co. However, the

directors of Cat Co do not feel that a takeover by Dog Co would be beneficial to

the shareholders of Cat Co in the long term. Therefore they are keen to prevent

the takeover from going through.

Which THREE of the following strategic defences could be used by Cat Co

in this situation?

A Refer the bid to the Competition authorities

B Poison pill

C Super majority

D Attack the bidder

E White Knight

48 Big Co has 20 million shares in issue, trading at $5 each. Small Co has

10 million shares in issue, trading at $2 each.

Big Co wants to acquire Small Co using a 1 for 2 share for share exchange. It

anticipates that synergies with a present value of $10 million will be generated

after the acquisition.

What is the expected share price of the combined company after the

acquisition? ________________

(enter your answer in $, to two decimal places)

405