Page 414 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 414

Subject F3: Financial Strategy

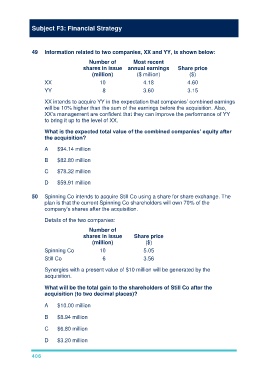

49 Information related to two companies, XX and YY, is shown below:

Number of Most recent

shares in issue annual earnings Share price

(million) ($ million) ($)

XX 10 4.18 4.60

YY 8 3.60 3.15

XX intends to acquire YY in the expectation that companies’ combined earnings

will be 10% higher than the sum of the earnings before the acquisition. Also,

XX’s management are confident that they can improve the performance of YY

to bring it up to the level of XX.

What is the expected total value of the combined companies’ equity after

the acquisition?

A $94.14 million

B $82.80 million

C $78.32 million

D $59.91 million

50 Spinning Co intends to acquire Still Co using a share for share exchange. The

plan is that the current Spinning Co shareholders will own 70% of the

company’s shares after the acquisition.

Details of the two companies:

Number of

shares in issue Share price

(million) ($)

Spinning Co 10 5.05

Still Co 6 3.56

Synergies with a present value of $10 million will be generated by the

acquisition.

What will be the total gain to the shareholders of Still Co after the

acquisition (to two decimal places)?

A $10.00 million

B $8.94 million

C $6.80 million

D $3.20 million

406