Page 417 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 417

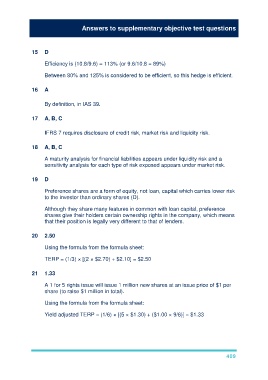

Answers to supplementary objective test questions

15 D

Efficiency is (10.8/9.6) = 113% (or 9.6/10.8 = 89%)

Between 80% and 125% is considered to be efficient, so this hedge is efficient.

16 A

By definition, in IAS 39.

17 A, B, C

IFRS 7 requires disclosure of credit risk, market risk and liquidity risk.

18 A, B, C

A maturity analysis for financial liabilities appears under liquidity risk and a

sensitivity analysis for each type of risk exposed appears under market risk.

19 D

Preference shares are a form of equity, not loan, capital which carries lower risk

to the investor than ordinary shares (D).

Although they share many features in common with loan capital, preference

shares give their holders certain ownership rights in the company, which means

that their position is legally very different to that of lenders.

20 2.50

Using the formula from the formula sheet:

TERP = (1/3) × [(2 × $2.70) + $2.10] = $2.50

21 1.33

A 1 for 5 rights issue will issue 1 million new shares at an issue price of $1 per

share (to raise $1 million in total).

Using the formula from the formula sheet:

Yield adjusted TERP = (1/6) × [(5 × $1.30) + ($1.00 × 9/6)] = $1.33

409