Page 421 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 421

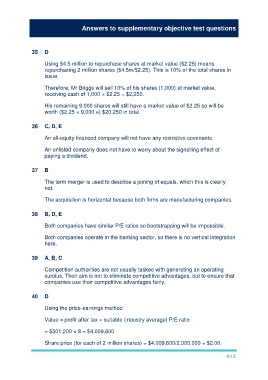

Answers to supplementary objective test questions

35 D

Using $4.5 million to repurchase shares at market value ($2.25) means

repurchasing 2 million shares ($4.5m/$2.25). This is 10% of the total shares in

issue.

Therefore, Mr Briggs will sell 10% of his shares (1,000) at market value,

receiving cash of 1,000 × $2.25 = $2,250.

His remaining 9,000 shares will still have a market value of $2.25 so will be

worth ($2.25 × 9,000 =) $20,250 in total.

36 C, D, E

An all-equity financed company will not have any restrictive covenants.

An unlisted company does not have to worry about the signalling effect of

paying a dividend.

37 B

The term merger is used to describe a joining of equals, which this is clearly

not.

The acquisition is horizontal because both firms are manufacturing companies.

38 B, D, E

Both companies have similar P/E ratios so bootstrapping will be impossible.

Both companies operate in the banking sector, so there is no vertical integration

here.

39 A, B, C

Competition authorities are not usually tasked with generating an operating

surplus. Their aim is not to eliminate competitive advantages, but to ensure that

companies use their competitive advantages fairly.

40 D

Using the price-earnings method

Value = profit after tax × suitable (industry average) P/E ratio

= $501,200 × 8 = $4,009,600

Share price (for each of 2 million shares) = $4,009,600/2,000,000 = $2.00.

413