Page 419 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 419

Answers to supplementary objective test questions

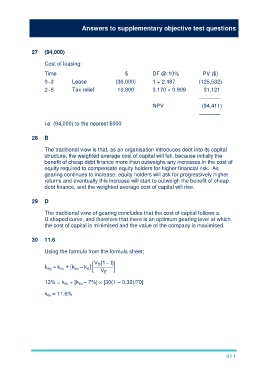

27 (94,000)

Cost of leasing:

Time $ DF @ 10% PV ($)

0–3 Lease (36,000) 1 + 2.487 (125,532)

2–5 Tax relief 10,800 3.170 × 0.909 31,121

–––––––

NPV (94,411)

–––––––

i.e. (94,000) to the nearest $000

28 B

The traditional view is that, as an organisation introduces debt into its capital

structure, the weighted average cost of capital will fall, because initially the

benefit of cheap debt finance more than outweighs any increases in the cost of

equity required to compensate equity holders for higher financial risk. As

gearing continues to increase, equity holders will ask for progressively higher

returns and eventually this increase will start to outweigh the benefit of cheap

debt finance, and the weighted average cost of capital will rise.

29 D

The traditional view of gearing concludes that the cost of capital follows a

U shaped curve, and therefore that there is an optimum gearing level at which

the cost of capital is minimised and the value of the company is maximised.

30 11.6

Using the formula from the formula sheet:

V [1 – t]

D

k = k + [k – k ] [ V E ]

eu

d

eg

eu

13% = k eu + [k eu – 7%] × [30(1 – 0.30)/70]

k eu = 11.6%

411