Page 423 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 423

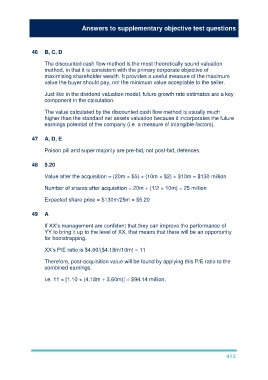

Answers to supplementary objective test questions

46 B, C, D

The discounted cash flow method is the most theoretically sound valuation

method, in that it is consistent with the primary corporate objective of

maximising shareholder wealth. It provides a useful measure of the maximum

value the buyer should pay, not the minimum value acceptable to the seller.

Just like in the dividend valuation model, future growth rate estimates are a key

component in the calculation.

The value calculated by the discounted cash flow method is usually much

higher than the standard net assets valuation because it incorporates the future

earnings potential of the company (i.e. a measure of intangible factors).

47 A, D, E

Poison pill and super majority are pre-bid, not post-bid, defences.

48 5.20

Value after the acquisition = (20m × $5) + (10m × $2) + $10m = $130 million

Number of shares after acquisition = 20m + (1/2 × 10m) = 25 million

Expected share price = $130m/25m = $5.20

49 A

If XX’s management are confident that they can improve the performance of

YY to bring it up to the level of XX, that means that there will be an opportunity

for bootstrapping.

XX’s P/E ratio is $4.60/($4.18m/10m) = 11

Therefore, post-acquisition value will be found by applying this P/E ratio to the

combined earnings.

i.e. 11 × [1.10 × (4.18m + 3.60m)] = $94.14 million.

415