Page 420 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 420

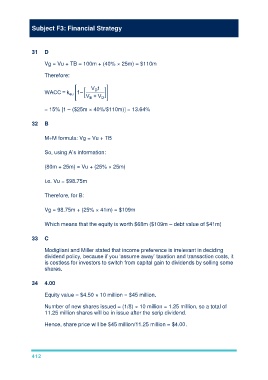

Subject F3: Financial Strategy

31 D

Vg = Vu + TB = 100m + (40% × 25m) = $110m

Therefore:

V t

D

WACC = k eu [1– [ ]]

V + V D

E

= 15% [1 – ($25m × 40%/$110m)] = 13.64%

32 B

M+M formula: Vg = Vu + TB

So, using A’s information:

(80m + 25m) = Vu + (25% × 25m)

i.e. Vu = $98.75m

Therefore, for B:

Vg = 98.75m + (25% × 41m) = $109m

Which means that the equity is worth $68m ($109m – debt value of $41m)

33 C

Modigliani and Miller stated that income preference is irrelevant in deciding

dividend policy, because if you ‘assume away’ taxation and transaction costs, it

is costless for investors to switch from capital gain to dividends by selling some

shares.

34 4.00

Equity value = $4.50 × 10 million = $45 million.

Number of new shares issued = (1/8) × 10 million = 1.25 million, so a total of

11.25 million shares will be in issue after the scrip dividend.

Hence, share price will be $45 million/11.25 million = $4.00.

412