Page 422 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 422

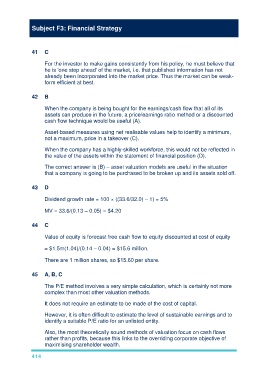

Subject F3: Financial Strategy

41 C

For the investor to make gains consistently from his policy, he must believe that

he is 'one step ahead' of the market, i.e. that published information has not

already been incorporated into the market price. Thus the market can be weak-

form efficient at best.

42 B

When the company is being bought for the earnings/cash flow that all of its

assets can produce in the future, a price/earnings ratio method or a discounted

cash flow technique would be useful (A).

Asset-based measures using net realisable values help to identify a minimum,

not a maximum, price in a takeover (C).

When the company has a highly-skilled workforce, this would not be reflected in

the value of the assets within the statement of financial position (D).

The correct answer is (B) – asset valuation models are useful in the situation

that a company is going to be purchased to be broken up and its assets sold off.

43 D

Dividend growth rate = 100 × ((33.6/32.0) – 1) = 5%

MV = 33.6/(0.13 – 0.05) = $4.20

44 C

Value of equity is forecast free cash flow to equity discounted at cost of equity

= $1.5m(1.04)/(0.14 – 0.04) = $15.6 million.

There are 1 million shares, so $15.60 per share.

45 A, B, C

The P/E method involves a very simple calculation, which is certainly not more

complex than most other valuation methods.

It does not require an estimate to be made of the cost of capital.

However, it is often difficult to estimate the level of sustainable earnings and to

identify a suitable P/E ratio for an unlisted entity.

Also, the most theoretically sound methods of valuation focus on cash flows

rather than profits, because this links to the overriding corporate objective of

maximising shareholder wealth.

414