Page 352 - Microsoft Word - 00 IWB ACCA F7.docx

P. 352

Chapter 24

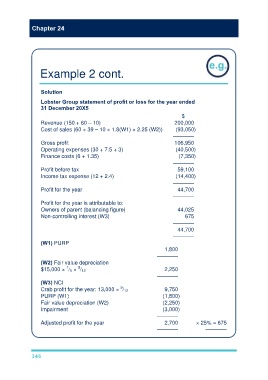

Example 2 cont.

Solution

Lobster Group statement of profit or loss for the year ended

31 December 20X5

$

Revenue (150 + 60 – 10) 200,000

Cost of sales (60 + 39 – 10 + 1.8(W1) + 2.25 (W2)) (93,050)

–––––––

Gross profit 106,950

Operating expenses (30 + 7.5 + 3) (40,500)

Finance costs (6 + 1.35) (7,350)

–––––––

Profit before tax 59,100

Income tax expense (12 + 2.4) (14,400)

–––––––

Profit for the year 44,700

–––––––

Profit for the year is attributable to:

Owners of parent (balancing figure) 44,025

Non-controlling interest (W3) 675

–––––––

44,700

–––––––

(W1) PURP

1,800

–––––––

(W2) Fair value depreciation

1 9

$15,000 × / 5 × / 12 2,250

–––––––

(W3) NCI

9

Crab profit for the year: 13,000 × / 12 9,750

PURP (W1) (1,800)

Fair value depreciation (W2) (2,250)

Impairment (3,000)

–––––––

Adjusted profit for the year 2,700 × 25% = 675

––––––– –––––––

346