Page 355 - Microsoft Word - 00 IWB ACCA F7.docx

P. 355

Answers

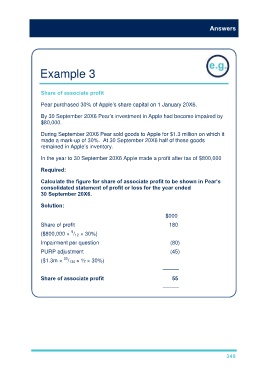

Example 3

Share of associate profit

Pear purchased 30% of Apple’s share capital on 1 January 20X6.

By 30 September 20X6 Pear’s investment in Apple had become impaired by

$80,000.

During September 20X6 Pear sold goods to Apple for $1.3 million on which it

made a mark-up of 30%. At 30 September 20X6 half of these goods

remained in Apple’s inventory.

In the year to 30 September 20X6 Apple made a profit after tax of $800,000

Required:

Calculate the figure for share of associate profit to be shown in Pear’s

consolidated statement of profit or loss for the year ended

30 September 20X6.

Solution:

$000

Share of profit 180

9

($800,000 × / 12 × 30%)

Impairment per question (80)

PURP adjustment (45)

30

($1.3m × / 130 × ½ × 30%)

———

Share of associate profit 55

———

349